Strategy

As an established industrial real estate investment trust (REIT), ESR-REIT is committed to optimise returns through the delivery of stable and secure returns to Unitholders and the creation of long-term capital growth.

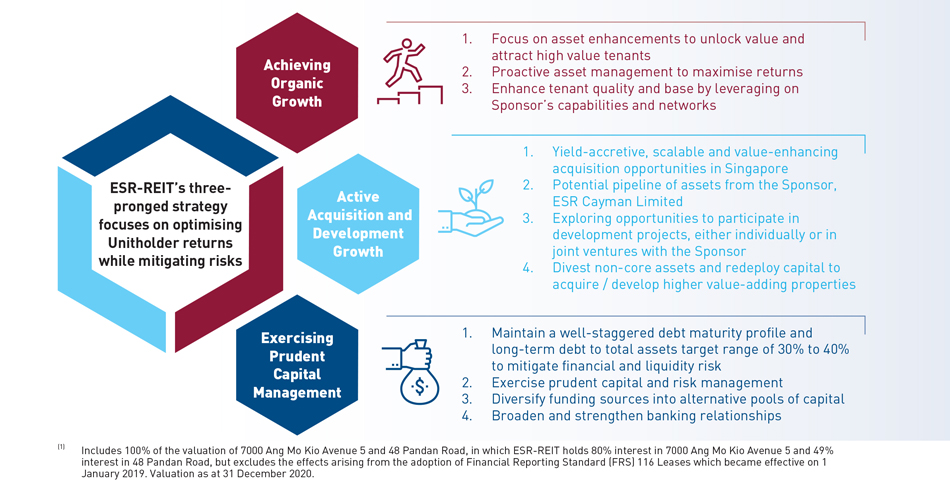

We have adopted a three-pronged strategy to achieve these objectives by leveraging on our expertise, enabling us to grow into a sizable Pan-Asian REIT.